does fla have an estate tax

Federal Estate Taxes. In Florida either the decedent or the estate needs to pay the property tax bill issued in the fall by March 31st.

Florida Attorney For Federal Estate Taxes Karp Law Firm

Does Florida Have an Inheritance Tax or Estate Tax.

. As noted above the Internal Revenue Service IRS requires estates with combined gross assets and prior taxable gifts exceeding 1170 million for the. A Florida Estate Gift Tax Attorney Can Help You. Federal government does have an estate tax.

If they owned property in another state that state might have a. Each county sets its own tax rate. Tax law is complex at the best of times but because of its unified nature estate and gift tax questions can be even worse.

The average property tax rate in Florida is 083. Cannot increase by more than 3 of the previous years assessment or the Consumer Price Index whichever is less. Federal estate tax return.

Floridas general state sales tax rate is 6 with the following exceptions. Available to all residents and amounting to a maximum of 50000 off the assessed value of the property. There are also special tax districts such as schools and water management districts that have.

The good news for Florida residents is that there is no such thing as estate tax under Florida law. Call us at 561 408-0729 or visit. Applicants have two options to apply.

The state constitution prohibits such a tax though Floridians. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. The blogs to follow will address specific issues to guide buyers to understand the process better and to help them avoid many of the pitfalls.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Note this is required only of individual estates that. Counties in Florida collect an average of 097 of a propertys assesed fair.

The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005. Due nine months after the individuals death.

The bad news is however that the US. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. To apply for a resale certificate you need to file Form DR-1 Florida Business Tax Application with the Florida Department of Revenue.

The strength of Floridas low tax burden comes from its lack of an income tax making them one of seven such states in the US.

New Tax Implications Vero Beach Florida Vero Beach Lawyer Vero Beach Attorney Jennifer D Peshke

Florida Inheritance Laws What You Should Know Smartasset

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

5 Great Florida Property Tax Appeals Numbers And Dates South Florida Law Pllc

Latest News Okeechobee County Edc

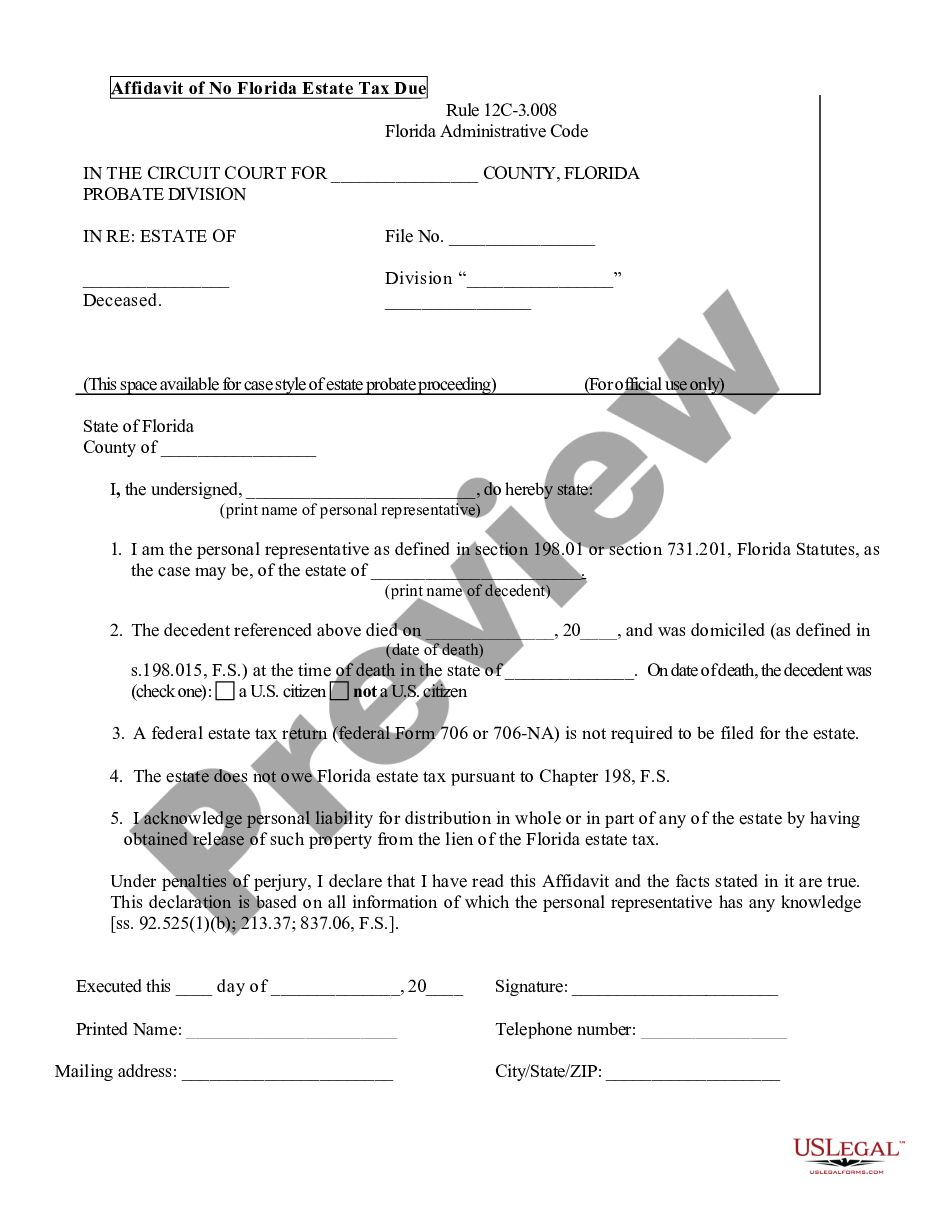

Affidavit Of No Florida Estate Tax Due Florida Affidavit Of No Estate Tax Due

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Tax Cases Page 2 Of 2 Florida Probate Trust Litigation Blog

Does Your State Have An Estate Or Inheritance Tax

Where To Get Florida Forms Dr 312 And Dr 313 To Show No Estate Tax Liability Tampa Bay Homes For Sale Re Max Acr Elite Group Inc

In Florida Homeowners Come For The Weather And Stay For The Tax Relief Mansion Global

What You Need To Know About Estate Tax In Fl

Dr 312 2002 Form Fill Out Sign Online Dochub

Florida Taxes Explained Villages Of Citrus Hills

Does Florida Have An Inheritance Tax Alper Law

Minnesota S Wealthy Caught In A Tight Tax Net Over Residency

Does Florida Have An Inheritance Tax

Estate Taxes For Florida Residents West Palm Beach Estate Planning Attorney